The most recent monthly update is on top, followed by archives going back to the first monthly update in December of 2011. Please join over 1.590 million visitors from 196 countries (speaking 154 languages) including 50 US States and visit our new website at www.financialecononomicupdate.com.

Financial, Economic and Social Mood Update (April 1, 2024)

The Dow Jones 30 Industrials Index hit a record nominal high of 39,889.05 and the NASDAQ Composite Index reached a record high of 15,538.86 on March 21, 2024. The S&P 500 Index hit a record nominal of high 5,264.85 on March 28, 2024. According to Elliott Wave technical analysis the stock market has never been so severely overly bullish or overbought. Nicholas Gerli of Reventure Consulting (an excellent YouTube channel about real estate investing with 502,000 subscribers) says something similar with respect not just to stock prices but to real property prices as well. Clayton & Natalie Morris (husband & wife veterans of Fox news) agree – their “Redacted” and “Morris Invest” channels have more than 2,547,000 subscribers. Many huge market players such as Warren Buffett, Tim Cook and Jamie Dimon are selling their own shares to the point of bailing out of their companies. Berkshire Hathaway (Warren Buffett’s holding company) is currently hoarding an unprecedented USD $157 BILLION in cash – this per Christopher Greene of AMTV (678,000 subscribers). This video by Elliott Wave International of Atlanta, Georgia shows how many insiders are selling in a big way and how they are hoarding cash in anticipation of bad times ahead: https://www.elliottwave.com/articles/stocks-what-to-make-of-all-this-insider-selling/?rcn=240327freeez&utm_source=com&utm_medium=eml&utm_campaign=ar-frup&utm_content=frupbsinsiderselling240321.

The main topic of this month’s blog is the current state of global representative government, or democracy (or the lack thereof). The topic of “democracy” has been over-used, abused and beaten to death by the so-called mainstream media. The current administration in Washington, D.C. and its circa 40 lackey countries around the world enjoy standing upon a soapbox and lecturing the rest of the world about how to think, talk, act and vote. In truth what they are doing has nothing to do with promoting freedom or democracy. It is much closer to promoting their own authority, to promote their own dictatorship and to promote their own form of modern colonialism or imperialism – a modern day equivalent of the so-called “white man’s burden” of the past – dictating to the peoples of the southern hemisphere how to live, worship, act, think and vote. It was all rubbish and rot back then, and it is so again today.

Most countries in the modern world have had or do have some form of multiparty representation in their legislatures. This includes current nation states such as Russia, China and Iran and it included the former Warsaw Pact or Comecon countries of Eastern Europe. Even North Korea has more than one “party” in its national legislature. There are not too many historical examples of countries with bona-fide one party legislatures – one that stands out is the former Third Reich after the National Socialist Party banned all other political parties from 1934 to 1945.

The USA and its lackey allies are governed by so-called mainstream political parties which truth in have very few important differences. When voters elect a “new” government they rarely get something truly different. In the USA this is referred to as the “uniparty” phenomenon. If one looks at the so-called elected representatives in Congress, one sees that something like 99 percent of Democrats and 90 percent of Republicans vote the same way especially when it comes to issues such as the forever-wars, the national debt, big pharma, investment banking and tax code laws. Much the same can be said for the lackey governments in countries such as Canada and the European Union (EU). Even worse, standing governments in countries such as the USA and Germany are attempting to ban their primary political opponents. This type of behavior makes them no better (it likely proves them to be even worse) than the governments they attack all over the world.

In the USA, the Biden administration is having its own appointed and corrupted judges and courts persecute both its number one Republican opponent (Donald John Trump) and its number one formerly Democratic and now Independent opponent (Robert Francis Kennedy, Jr.) – they have gone so far as to deny Kennedy protection by the Secret Service. They are also attempting to prevent Mr. Kennedy from even appearing on the Presidential ballot for most American states.

The 27 countries of the European Union (EU) will hold so-called elections for a new session of the European Parliament in Strasbourg, Alsace (France) between June 6 and 9, 2024. Fully 36 percent of European voters are likely to support political parties which the governing parties in Europe label as “unacceptable.” In truth it is not these parties outside of the so-called political mainstream which are not democratic – it is the governing parties which are behaving in a way which is undemocratic. A primary example is that of the Federal Republic of Germany. The second largest political party in public opinion polls is the conservative “Alternative for Germany” party (“AfD” initials in the German language) which is constantly falsely accused in the mainstream media of being “neo-Nazi.” This accusation is inaccurate, unfair and is nothing less than character assassination. The AfD stands for things such as ending the forever wars (especially the one in the Ukraine being waged against the Russian Federation), controlling illegal immigration, ending the “woke” political social agenda being pushed on the national or federal level and ensuring the financial solvency of the overall pension system. None of this is undemocratic in any way, shape or form. On the other side of the German political spectrum is the new “Bund Sarah Wagenknecht” – named after its number one candidate and standing for an immediate end to the forever war against Russia and for an end to the North Atlantic Treaty Organization (NATO).

If any parties need to be considered for a “ban” it should be the so-called mainstream political parties in the western countries which are behaving like the fascists of the past. In other words, parties led by people who will not tolerate anyone else who disagrees with them. In this sense, the western countries need to return to a sense of “normalcy” which existed decades ago.

Financial, Economic and Social Mood Update (March 1, 2024)

The Dow Jones 30 Industrial Index hit a record nominal high of 39,282.28 on February 23, 2024 and the S&P 500 Index reached a nominal high of 5,140.33 on March 1, 2024. The NASDAQ Composite Index also reached a record nominal high value of 16,302.24 on March 1, 2024. According to Elliott Wave technical analysis the stock market has never been so severely overly bullish or overbought. We can make the same statement for virtually all classes of assets including for real property. The overall global stock market is 45 percent below its record nominal high from December of 2021, and the overall cryptocurrency market is 66 percent below its record nominal high from November of 2021. We are witnessing nominal & real bear market retracement – this is not a real bull market. Never forget for one moment that our nominal fiat currencies have become so decimated – i.e. in real terms we are much less affluent today than we were in the past. Some billionaires and millionaires at the very top (but not all of them – not all of them are dishonest) are getting ever richer and more powerful……………….in particular those on the side of the World Economic Forum (WEF) led by Klaus Schwab in Switzerland who controls most western governments and the all-powerful investment banking trio of Blackrock, Vanguard and State Street who in turn control the all-important corrupt industries of investment banking (the business of robbing us blind), defense (endless wars) and big pharma (the business of poisoning us). These 3 all-powerful and corrupt investment banks are literally in the process of trying to buy up every asset on earth. They already own and control 55 percent of publicly held corporations on the planet and are trying to gobble up the remaining 45 percent (note that this figure corresponds exactly to the global stock market value I listed above). And note the real reason for every single war being waged on earth today (and ever war waged in human history) – it is to rape and pillage the countries where the actual killing takes place. Blackrock, Vanguard and State Street now own 40 percent of all arable land in the Ukraine and China owns another 9 percent thereof. THIS WAR NEVER SHOULD HAVE HAPPENED IN THE FIRST PLACE. Total fault for this war lies on the doorstep of the US government and NATO for even keeping NATO alive after the demise of the former Warsaw Pact, for expanding NATO toward the former Warsaw Pact countries, the former Soviet Union and the current Russian Federation and for overthrowing the legally and freely elected government of the Ukraine in 2014.

Why are nominal prices so high? Why is the purchasing power of our money so low? Why is the standard of living for most people lower now than it used to be years or decades ago? The answer to these questions lies in the creation of central banks – most countries have them. In the USA this was done in the year 1913 with the establishment of the Federal Reserve System. The first modern central bank was established in England in the year 1694. These banks are not “government” institutions in the true sense. They are actually owned by the biggest commercial banks, which are in turn owned by the wealthiest and most powerful families on the planet – but don’t waste your time by looking for these families on the “Fortune” or “Forbes” lists. Their real names are the likes of Rothschild and Rockefeller.

Central banks “print” or “create” money out of thin air and then they lend this money to their member (owner) banks which in turn make loans into the overall economy – for governments, corporations and to individuals for mortgages, auto loans, student loans, credit card loans and the like. THIS is the reason for our hyperinflation, which has taken place worldwide. For instance, the purchasing power of the US Dollar has fallen by 96 percent since 1913 – the story is similar (somewhat more or somewhat less in terms of percentage decimation of the currency) worldwide.

ALL prices are thus inflated for whatever products or services, for whatever tangible or non-tangible items. GDP or GNP (Gross National Product or Gross Domestic Product) numbers are also thus extremely inflated especially for countries such as the USA. To see this, look no further than what an average family earns compared to the “per capita” Dollar figures for GDP and GNP. In the case of the USA, the GDP numbers are inflated by an astonishing 85 percent! That is correct – 85 percent of the modern American economy consists of “funny money” which of course is not funny at all.

The USA also has no fewer than 28 million illegal immigrants today – the actual number is more like 40 million and the largest estimates go as high as 52 million individuals. The American government on all levels (national, state and local) prints, taxes and spends USD $500 BILLION per year as of 2024 to support these people in the way of income assistance (welfare), medical care, housing, transportation to the city of their choice and so forth. This madness cannot and will not continue. The end result will be the economic and social order collapse of the USA and of other countries doing something similar. These other countries are the “lackey” countries of the USA – largely located in North America, the UK, Europe (the European Union, the EFTA and NATO) and in limited locations elsewhere on the globe: Japan, South Korea, Taiwan, the Philippines, Israel, Australia, New Zealand, Paraguay and Haiti. The rest of the world is on the other side of the fence – the side of the BRICS countries, of the Shanghai Cooperation Organization (SCO) and of China’s Belt & Road Initiative (BRI or B&R) to which 155 countries belong.

Financial, Economic and Social Mood Update (February 1, 2024)

The Dow Jones 30 Industrial Index hit a record nominal high of 38,588.86 on January 31, 2024 and the S&P 500 Index reached a nominal high of 4,931.09 on January 30, 2024. According to Elliott Wave technical analysis the stock market has never been so severely overly bullish or overbought. We can make the same statement for virtually all classes of assets including for real property. The cryptocurrency market is performing no differently from the rest of the market – it is very closely correlated with the overall asset market. In fact the cryptocurrency market is even more closely correlated with the overall global stock market, which hit a nominal peak about two years ago toward the end of 2021. The overall global stock market is 48 percent below its record nominal high from December of 2021, and the overall cryptocurrency market is 76 percent below its record nominal high from November of 2021. We are witnessing nominal & real bear market retracement – this is not a real bull market.

The following video from Elliott Wave International of Atlanta (less than 4 minutes long) articulates the problem we have today where too much real estate is owned not by homeowners, but by so-called “investors.” When too much property is owned by the latter, the real estate market behaves and performs like the stock market – in other words, it is subject to boom and bust which can destroy values for many homeowners: https://www.elliottwave.com/articles/u-s-real-estate-a-24-problem/?utm_source=com&utm_medium=eml&utm_campaign=ar-frup&utm_content=frupbsrealestate240104.

The following excellent video interview of retired US Army Colonel Douglas MacGregor by Judge Andrew Napolitano (34 minutes long) clearly illustrates how the western world order led by the USA and its lackeys in Europe, North America, Israel, Japan, South Korea, Taiwan and the Philippines is on its last leg: https://www.youtube.com/watch?v=GqNWKJENDLY.

The war in the Ukraine is lost to Russia (and Russia NEVER should have been provoked by the west into this war in the first place). Civil unrest in countries such as the Netherlands, Belgium, France, Germany, Italy, Spain, Portugal, Poland, Romania, India and even Switzerland illustrates how the failed European Union (EU) and North Atlantic Treaty Organization (NATO) are now on their last leg. Countries such as Sweden and Finland (long neutral and at peace) are now tempting fate by taunting Russia as did the now defeated Ukraine.

Both Europe (30 million illegal immigrants) and the USA (40 million illegal immigrants in the USA or 12 percent of the entire US population) are self-destructing by opening their borders to an unlimited number of illegal immigrants from all over the world, most of whom are not financially independent and most of whom having no desire to integrate into western society. Kudos to the 700,000 patriotic American truckers headed to defend the US border with Mexico and ditto to the even larger number of farmers protesting their own criminal governments mostly in Europe – protesting not merely illegal immigration but in a much larger sense the criminal agenda emanating from the World Economic Forum (WEF) in Cologny and Davos, Switzerland.

The war in the Middle East has now devolved into a war of attrition which Israel, the USA and the EU (NATO) will lose. The political power structure in the Islamic World (1.9 BILLION people) backed by Russia, Mainland China and much of the Eurasian continent (the overwhelming majority of humanity on planet earth – 75 percent of humanity) have now decided that the post-World War One (1914-1918) and post-World War Two (1939-1945) political structure have come to an end………………….which will mean the end of Israel as it has been known since 1948. Rabbi Yisroel Dovid Weiss has the right idea about an end to war and to people living in peace: https://en.wikipedia.org/wiki/Yisroel_Dovid_Weiss.

The bottom line is this. Virtually every single war that has been fought in the entirety of recorded human history ought not to have been fought. The overall situation and the lives of most human beings on this planet are usually WORSE (and not better) after the end of every single war.

From the standpoint of the western world (western civilization in general) rolling back the clock to before the start of World War One in the fateful and tragic summer of 1914 would be a good thing. It was a much more stable world compared to what exists today. The problem it needed to address is that the majority of world’s population (non-Europeans or non-Caucasians who lived under western authority) were minimalized in terms of their political privileges and economic livelihood. That situation will not be repeated today at least because these parts of the world (eastern civilization and the southern hemisphere in general) are no longer as undereducated or as powerless.

Our world is now undergoing a tremendous amount of traumatic change, some of which we can influence and much which we cannot. The world of future which we must start building today must be a world free from war and free from financial corruption. It must also be a world in which we view each other not as members of groups (“identity politics” as we know it today must cease to exist) but as individuals…………………..it reminds me of what the late Reverend Dr. Martin Luther King, Jr. said in his “I have a dream” speech.

Financial, Economic and Social Mood Update (January 1, 2024)

The Dow Jones 30 Industrial Index hit a record nominal high of 37,778.85 on December 28, 2023. According to Elliott Wave technical analysis the stock market has never been so severely overly bullish or overbought. We can make the same statement for virtually all classes of assets including for real property (note the new video link below by Nicholas Gerli of Reventure Consulting). The cryptocurrency market is performing no differently from the rest of the market – it is very closely correlated with the overall asset market. In fact the cryptocurrency market is even more closely correlated with the overall global stock market, which hit a nominal peak about two years ago toward the end of 2021. The overall global stock market is in fact still 48 percent below its record nominal high from December of 2021, and the overall cryptocurrency market is still 76 percent below its record nominal high from November of 2021. We are witnessing nominal & real bear market retracement – this is not a real bull market.

The three largest mega investment banks of Blackrock, Vanguard and State Street own fully 80 percent of the S&P 500 corporations and 60 percent of American real estate (commercial and residential real property).

The effects of the global pandemic hyperinflation are also not leaving us. The overall cost of living has more than doubled in just two short years. In the USA, fully 78 percent of families rent their residences as opposed to own them or owe a mortgage on them. More than 8.2 percent of the American population is comprised of illegal migrants – one out of every 12 people now in the United States of America. All of the above trends represent a very real and present danger toward the survival of free enterprise and toward representative democracy in the USA.

Here is a new video from Nicholas Gerli of Reventure Consulting which demonstrates how the retail consumer economy is collapsing – freight shipments and trucking companies are hurting because consumer demand (70 percent of GDP) is imploding: https://www.youtube.com/watch?v=qNN8N4Z9WAA.

Many people tout certain commodities (i.e. precious metals such as gold and silver) as the ultimate and/or perfect hedge/protection against inflation, the high cost of living, etc. This is yet one more of many fallacies broadcast by many sources in the investment community, certain religious communities and in some of the alternative media. Here is a good video from Elliott Wave International of Atlanta which shows that this is basically NOT true: https://www.elliottwave.com/articles/is-inflation-bullish-for-gold-and-silver/?rcn=231231socez&utm_source=com&utm_medium=eml&utm_campaign=ar-frup&utm_content=231231socez.

The mainstream media also do not tell the truth with respect toward the global wars they support. The war in Eastern Europe has pretty much come to a standstill and the situation equals an unqualified victory for Russia. For all intents and purposes the Ukraine no longer exists as a national entity. The situation in the Middle East is likewise not what the media tells us. Sources within Israel confirm that Israeli military casualties are much higher than what is reported (3,700 killed in action plus 5,000 wounded including 2,000 permanently maimed as of December 14), and that the Netanyahu government has an approval rating within Israel in the low single digits. Israeli civilians have to a large degree vacated (left, moved out of) both their northern and their southern provinces due to a lack of trust in their own government’s ability to protect them. Shipping traffic in the Red Sea (Suez Canal) has fallen to almost nil due to Yemen’s support of the military forces of occupied Palestine in the Gaza Strip and on the West Bank of the Jordan River. And other players which have yet to enter this war are much, much lethal than either Hamas in the Gaza Strip or Yemen on the Arabian Peninsula – Hezbollah in Lebanon, Iran, Ottoman Turkey (yes, Ottoman), Russia and Mainland China.

Every single war (without exception) must be immediately negotiated to a cease fire. All or most American military forces must be withdrawn from the more than 170 countries around the world and returned to the continental USA, where they must be immediately deployed to protect America’s borders – especially the southern border with Mexico – to stop the flow of illegal migrants which now exceeds 28 million people and which is growing at a rate of more than 5 million more individuals per year. Those who cannot or will not integrate into American society must be permanently deported and those who can must either serve as enlisted personnel in the US military or earn their financial keep until they can attain legal status within our legal system.

Financial, Economic and Social Mood Update (December 1, 2023)

The so-called “mainstream media” says almost nothing about it, but the old order as we have known it is now in the process of crumbling to the ground. If the powers-that-be tell us something, we can be assured that the actual truth is the opposite of what they say. We are told that the economy is doing well. It is not. We are told that the labor market is strong and robust. It is not. The cost of living has been inflated due to the central banking system creating “credit” out of thin air, and due to governments (especially in the USA) spending money which does not exist. The levels of debt of all types which now exist are beyond anything ever seen in recorded history. The same is true for prices – especially for asset prices of all types of assets. The cost of borrowing cannot and will not go down until this debt disappears, and that will be utterly difficult as “deflation” is historically even more painful and destructive compared to “inflation.” Elliott Wave International recently posted two (2) good articles / videos about historical interest rates. The first video discusses the cost of borrowing (i.e. interest rates) going back 5,000 years: https://www.elliottwave.com/Interest-Rates/Interest-Rates-What-a-5000-Year-Chart-Suggests-is-Next?utm_source=com&utm_medium=eml&utm_campaign=ar-frup&utm_content=frupbsinterestrates231116.

The second video discusses the cost of borrowing going back 700 years: https://www.elliottwave.com/Social-Mood/Mood-Riffs-Interest-Rates-from-1300s-Through-Today-What-History-Teaches-Us?rcn=231119socez&utm_source=com&utm_medium=eml&utm_campaign=ar-frup&utm_content=231119socez.

Endless War

Just as the old Roman Empire fell, so will every empire eventually fall. We are witnessing this collapse in real time in the USA and with its “military industrial” complex in the form of the so-called “North Atlantic Treaty Organization” (NATO). The old Austro-Hungarian Empire (1867-1918) was itself a successor state to the “Holy Roman Empire of the German Nation” (800-1806) – which was itself an attempt to restore old Rome (753 BC to AD 476). The shadow leadership of Austria-Hungary believed that war was the only way to preserve and save their empire. This utterly insane way of thinking led to World War One (1914-1918) which of course destroyed many empires and paved the way for a Second World War (1939-1945) which was even more destructive than the first.

The thinking behind the scenes in today’s Washington, DC is much the same – war in Europe against Russia, war in the Middle East against the entire Islamic world and a potential war against Mainland China over the small island of Taiwan. War is never good – it is always bad. Most of the casualties of war are innocents, civilians and conscripted (drafted) soldiers – not the guilty parties who caused those wars in the first place. Responding to violence with violence only ensures more violence.

Politicians, industrialists, so-called non-governmental “think tanks” and so-called “religious leaders” are the ones who more often than not call for war – and they are NEVER the ones who must fight and die in those wars. In Europe, the battered Ukraine must now negotiate peace with Russia – something which should have taken place years ago – either in early 2022 or even better in 2014. The Ukraine has gone from 90 million people down to less than 20 million people. They are an historical breadbasket especially for Europe, and they will need many immigrants who are willing to do hard honest work on farms if the Ukraine is ever to get back on its feet.

The so-called “Holy Land” must move beyond the never-ending decades of violence since 1948 and accept the concept of “one person, one vote” where all people are legally equal regardless of race, religion or ethnic background.

Politicians and some so-called “religious leaders” like to bang their holy books and have other unfortunate people bang guns. They should take heed that “the meek shall inherit the earth.” I am not one, but I greatly admire the Amish and their fellow Mennonites who lead utterly peaceful and productive lives. They have the highest rates of procreation on earth, they refuse to take up arms, they refuse in serve in any military and they refuse to partake in the Social Security pension system. If everyone on earth were more like them, the world would be a much more peaceful place, a much safer place, a more productive place, and a healthier place. People would live within their financial means and there would be very little crime or violence.

At the end of the day, we should remind ourselves how much better life on earth would be without armaments and endless wars. Our standard of living would be much higher than it is today. Think for a moment of all the hope for the future which has never or not yet materialized. Those of us who are old enough can remember things like General Motors Corporation “Futurama” before and after World War 2, or Walt Disney Land’s “the world tomorrow” as showcased during the 1950s and 1960s.

It is high time to make war itself “illegal.”

Financial, Economic and Social Mood Update (November 1, 2023)

The mainstream media does not report this in the USA or other western countries, but the Ukrainian Army has lost a staggering 12,000 tanks since the ground war in the eastern and southern Ukraine commenced in February 2022 – much of what used to exist in the active duty and reserve forces of the NATO countries before they were shipped to the Ukraine. Furthermore, there are reports of a newly surrounded (entirely encircled by the Russian Army) contingent of 200,000 Ukrainian troops (largely untrained conscripts, older men, younger men & boys and even women). Russian Army forces in the region number anywhere from 750,000 to 1.2 million well-trained, well-equipped and well-led men. The number of other troops and reservists in the entirety of Russia may be has high as 20 million men. The number of active duty, reservist and militia forces in Russia’s ally Mainland China may be as high as 110 million men and women.

The war in the so-called “Holy Land” (Israel, the Golan Heights and the occupied left over Palestinian lands of the West Bank of the Jordan River & the Gaza Strip which borders the Egyptian Sinai Peninsula) now looks to be a bona fide prelude to World War 3. The Arab-Israeli Conflict dates back to May 15, 1948 (the founding of the modern State of Israel). In between then and October 7, 2023 cumulative casualties were 25,343 on the Israeli and 91,105 on the Arab side. Since October 7, 2023 we have already seen casualty counts up to 7,147 on the Israeli and 36,275 on the Arab side with refugee counts up to 500,000 on the Israeli and 1.4 million on the Arab side (one out of 6 Arabs in the Holy Land). The countries or organizations mobilizing their military forces to some extent in support of Palestine include Hamas (Gaza Strip), Hezbollah (north of Israel), Iran, Turkey, Pakistan, North Korea, Syria, Yemen, Saudi Arabia, Iraq, Lebanon and Egypt with more than 36 million potential military personnel including reservists and conscripts.

This is lose-lose situation for all sides – especially for civilians on any side. Responding to violence with violence merely begets more violence, and most casualties will inevitably be civilians who have nothing to do with any of the original violence. The situation after any and all wars is inevitably worse than the situation before a war. The ongoing wars in the Ukraine and now in the Middle East should demand negotiation (talking and speaking on civil terms) and not more violence.

A far more constructive policy would be to enfranchise the Arab population in the Holy Land so that they could increase their representation in the Knesset (Israel’s parliament), where they continue to be grossly under-represented………………..here they could at least join forces with the likes of the local Israeli Labor, Green and Communist parties to act as a counter balance to the extreme right wing Likud Party and its allies – not that I endorse socialism, communism or woke environmentalism (I do not, but that these parties in Israel happen to support peace with other people such as the Arabs, Druze & Christians). Note that left wing parties throughout Europe and North America are now driving the entire world toward a Third World War which is 100 percent WRONG – in this case, voters must support their right of center opposition to counter this madness. The end goal should be to have people of all backgrounds co-exist together in peace and to respect each other’s differences – to tolerate differences, to respect differences and to not attempt to change people who are different.

With respect to the economy, what need be said? The cost of living in the USA has increased by a staggering 100 percent in three (3) short years. Global equity markets (never mind watching the useless and dishonest mainstream media) have lost 54 percent of their value in the same short span of time. We have the worst and most corrupt political leadership ever, and these criminals have put all of us on the cusp of a Third World War in the Ukraine against Russia, in the Holy Land against the Islamic world, in Taiwan against Mainland China and on the US southern border with Latin America.

Remember what the thoroughly pacifist Albert Einstein said – he did not know with what weaponry World War 3 would be fought, but World War 4 would be fought with sticks and stones. Those who fail to learn from the mistakes of the past are condemned to repeat the mistakes of the past.

The only solution is mutual respect, tolerance for differences, leaving everyone alone and PEACE.

Financial, Economic and Social Mood Update (October 1, 2023)

The standard of living in today’s America is actually lower compared to what it was during the Great Depression of 1929 to 1949: https://prepareforchange.net/2023/09/12/we-definitely-are-in-the-great-depression-they-just-want-to-make-us-think-were-not/. During the Great Depression, a home cost 3 times the average salary, today a home costs 8 times the average salary. An automobile cost 46 percent of an average annual salary 90 years ago, today that cost is 85 percent. 12 months of rent cost 16 percent of annual salary in the 1930s, today that is up to 42 percent.

America long had one of the highest rates of home ownership in the entire world – today, it has one of the lowest rates. 100 million of 129 million US households are renter households, or 78 percent of the total. And of the 22 percent “homeowners” average equity is much lower than it used to be – no more than 38 percent in 2011. Furthermore, 44 percent of existing homeowners are using their home much like an ATM (Automated Teller Machine) by doing things like refinancing, taking out a home equity line of credit (HELOC) or older people above age 62 doing a reverse mortgage. This “credit” is being used for things like expensive home remodeling, student loan debt, auto debt, medical debt, credit card debt or taking trips / vacations…………………NOT a good idea.

Yet another “elephant in the room” is ESG debt. “ESG” stands for “Environmental, Social and Governance” and is of course being pushed by the likes of the WEF (“World Economic Forum” led by Klaus Schwab in Switzerland) – they are behind much of the blatant lies behind “climate change, global warming and destructive / divisive / dishonest woke politics.” The loss in ESG bond debt to date is a staggering USD $18 TRILLION since its peak in March 2020.

Note that crude oil, natural gas / methane and coal are NOT harming the earth. Note that BEV (lithium) battery electric cars will not help the environment. Note that giant onshore and offshore windmill farms will NOT save the planet. Fossil fuels and “carbon” are NOT harmful. Note that fossil fuels are entirely natural and that they are naturally re-generating – they will never go away and are a useful and necessary resource – “fossil” refers to the fact they are sourced from dead plants and animals over long periods of time. “Carbon” is necessary for growth. Mining lithium is already destroying (yes – destroying) the environment of many countries in South America and Africa. Unwanted old electric cars are already piling up in junkyards in Mainland China. If we care about reducing pollution, there are alternatives to gasoline even beyond ethanol (made from corn in North America, made from sugar cane in South America and made from palm leaves in Asia) and beyond natural gas (which has replaced coal in places such as Texas). The big alternative is hydrogen, which is the most common element not merely on earth but throughout the universe. Hydrogen can power automobiles, commercial trucks, ships and aircraft. The exact same energy companies producing crude oil and natural gas products can produce hydrogen, and they can distribute (sell) hydrogen through the already existing retail network of gasoline service and convenience store locations. No more of the nonsense of the BEV lithium battery electric car – limited range, long recharging times (often overnight), limited recharging stations and even poorer performance in hot and cold conditions.

And note this: the haywire weather in certain places has NOTHING to do with the lie of “climate change” or “global warming.” The number one reason is beyond the control of anyone on earth. It has to do with a large celestial body (a planet 7 times the size of earth) which has an elliptical orbit bringing it to our neck of the woods an average of every 317 years over the last 6,024 years – sometimes fewer years, sometimes more years, sometimes closer to the earth and sometimes farther from the earth. This time around it is coming much closer to the earth. Since it is so large and with such a long “tail” (multiple moons and other debris) the earth will always be the clear “loser” in such an encounter – i.e. massive seismic activity, volcanic eruptions, earthquakes, plate movements and moving the continents complete with massive coastal flooding, tsunamis and much less land above water at the end of the day.

Why is this story barely in the media? Because the people in power (your corrupt buddies in the World Economic Forum and the world leaders who do their bidding) do not want you to panic, do not want you to stop working and do not want you to stop paying your bills.

Another lie from the mainstream media and “uniparty” political establishment worldwide is the so-called Covid 19 pandemic – it is actually a “plan” demic and a “scam” demic. The virus was deliberately created and released into the public (much like AIDS was in the 1980s). Covid came from a laboratory in Wuhan, China ultimately owned by George Soros and his buddies of the World Economic Forum (WEF) run by Klaus Schwab in Switzerland. Even more criminal are the so-called RNA DNA-altering vaccines. It is the people injected with the vaccines that are getting sick and dying off. The healthiest population on earth is the Amish who have nothing to do with masks (they merely prevent breathing & recirculate dirty oxygen), social distancing (especially bad for childhood development), lockdowns (they have killed off untold numbers of small businesses) and vaccines (circa 200 million dead since 2019 and at least 2 BILLION with adverse effects worldwide, largely due to heart failure). The original plan was for 2 initial shots plus 5 boosters (a total of 7 shots). To date six (6) shots have been released as of September 30, 2023. Number 7 will come one year later………………..unless it can hopefully be stopped. Covid is basically like the common cold or Influenza. People with weak immune systems have always (and will always) succumb to such illnesses. Shutting down the entire world makes no sense whatsoever.

The criminal Biden-Harris administration and their lackeys worldwide (mostly in western Europe) continue to provoke Russia and her many allies into a Third World War. Since the ground war in the Ukraine is over (Russia has won that), and 92 percent of the prewar Ukrainian population has been either killed off or driven out of their homeland as refugees, the USA is now shipping its last reserve of guided missiles to be fired against Russian targets mostly in the Crimea and around Moscow. The Americans have also deployed Polish, German and American troops into the eastern & southern Ukrainian theater of war. The Poles are the largest contingent, numbering well into the thousands. At least 20 US servicemen have been killed in combat and more wounded have been evacuated to US military hospitals located in southwestern Germany. Here is a very disturbing story from the Russian news about a destroyed German Army tank crew in the Ukraine (no western troops should even be here in the first place): https://sputnikglobe.com/20230923/russian-reconnaissance-team-destroys-leopard-tank-in-special-op-zone-with-fully-german-crew-1113608814.html?fbclid=IwAR0-cu6UhrLjK7WPtgXxgCg5G9lQke4fxJmCMC6VsLxoR45qJ2BYtbs0UuQ.

This madness and criminality on the part of the USA and its lackeys will merely force Russia to march west in the name of self-defense and self-preservation. This insanity must be stopped immediately or the world will have Hell to pay for it.

One of my subscribers sent me a link which sums up in just 5 minutes how the World Economic Forum (WEF) led by Klaus Schwab in Switzerland is behind all of the bad things (lies and evil agenda) listed above: https://twitter.com/wideawake_media/status/1707372401338589250?s=46&t=Kij2hXmN_0Y05qC3lnygMw&fbclid=IwAR0-FPzoCW-zHWjXOjL5mfk_hZXN_h7cQSSY9IRnYniiKDlUQwX0-qggNTs.

Mark Mallett of Canada sums up the same idea but far more extensively in his most recent blog posted on September 28: https://www.markmallett.com/blog/the-great-theft/?fbclid=IwAR2ZNLf8HMJAtTsnKNlb-IMBwMQEv-B4oc9RTKZ-E4Xdp3kgLLXKtSmobgM

Yet another link sent to me by a subscriber sums up in one minute how the World Economic Forum (WEF) will never stop thinking up of new lies in their effort to gain control over all of humanity, all life on earth and the entire planet: https://twitter.com/wideawake_media/status/1708082741370139037?s=46&t=Kij2hXmN_0Y05qC3lnygMw&fbclid=IwAR3m_PPgyVTrf4OiuIHHUEDFtAmY-rO45BELaiN7Ag4ZPlR7NybjDe2ZBUo.

Financial, Economic and Social Mood Update (September 1, 2023)

Everywhere one looks, one can see evidence of the USA and the western world crumbling. Ignore whatever you see or hear on mainstream media, because absolutely nothing of what they say is true. More countries continue to move ever further away from the American Dollar. The recent BRICS summit in South Africa saw 6 countries join the original 5 members for a new total of 11 nations which control an impressive 80 percent of the entire world’s crude oil market. Note that natural gas, natural gas byproducts and coal are found wherever crude oil is found – these are necessary and valuable resources which will never disappear. An additional 14 nations are waiting in the wings to join the BRICS 11 and many more countries attended the summit as observers.

At least 19 European countries are refusing to supply the criminal dictatorship in Kiev with support, which is a small step in the right direction – no country should be supplying them with anything other than humanitarian aid, and even that is highly questionable given their extreme level of corruption (because any aid will never reach its intended beneficiaries). Zelensky’s mother-in-law recently spent USD $4.8 million on a villa in Egypt. This disgusting robbery of US taxpayer money is much like Hunter Biden recently renting a brand new home in Malibu, California for USD $15,800 per month.

Bobby Kennedy, Jr. (one of the very few honest Democrats left) recently highlighted the fact that the massive investment banking houses of Blackrock (based in New York), Vanguard (based in Pennsylvania) and State Street (based in Boston) now control / own 88 percent of all corporations listed on the S&P 500 and a whopping 60 percent of American real estate. This is the reason for asset prices being so outrageously inflated – they continue to bid up prices in an effort to corner the entire market. The average price of a single family residence in the USA has doubled in just two years – from over USD $200,000 two years to ago to more than USD $400,000 today. Kennedy is correct. The big banking houses continue to target privately held corporations in an effort to expand their web of control and to promote their evil “woke” political agenda. Both of the 2 big political parties in Washington DC have submitted themselves to the evil will of the World Economic Forum (WEF) and its perverted “woke” agenda – say 99 percent of the leadership of the Democratic Party and about 90 percent of the leadership of the GOP (Republican Party).

The true state of the US economy is utterly horrific. Per capita federal government debt now equals USD $840,000 for every man, woman and child in the USA. An astounding USD $240,000 of this total is due solely to the criminal Ukraine war which is being waged against the Russian Federation. The median American family earns just USD $31,000 per year, of which they pay USD $16,600 in all forms of tax. The average retired American Social Security recipient is paid USD $1,400 per month while the average illegal immigrant is given USD $2,200 per month – this outrage must stop immediately……………………the latter figure must be lowered to ZERO. Families who have lost everything in the recent Maui fire are being paid a paltry USD $700 by the criminal Biden-Harris dictatorship while useless FEMA employees are spending USD $1,000 per night in luxurious Maui resorts. Bank and retailer credit card losses are soaring, and rich Americans are now starting to exhibit behavior not seen since the Great Depression of 1929 to 1949: they are cutting back on luxury in an effort to hide themselves from the huddled masses who are in severe financial distress. Consider that the average American CEO is paid (given) 400 times what the average employee is paid. Trucking companies are now charging 15 to 25 percent below what they spend in cost – this cannot last much longer as many of these companies are going under. Since 2020 the US Federal Reserve Bank has not required commercial banks to maintain cash reserves – this is downright reckless and criminal. No wonder that public trust of major political and business institutions now ranges between 8 and 27 percent, with 73 to 92 percent of the US population having no more trust in our political institutions, mainstream media and big businesses.

The ten (10) most expensive housing markets in the USA per Nick Gerli of Reventure Consulting: https://www.youtube.com/watch?v=OT03LXtDqBU&t=710s. Note that the average brand new mortgage in the USA now costs USD $2,900 per month and that this figure is USD $8,000 per month in the most expensive US metro area of San Jose-Silicon Valley, California while the average family in the USA earns just USD $2,583 per month. 78 percent of US households are now renter households (i.e. not homeowners) one third of these renter households (one quarter of the entire US population) is going into debt to pay their monthly rent.

In short, the ship is sinking FAST.

Financial, Economic and Social Mood Update (August 1, 2023)

If we step back and view the world unlike the 100 percent dishonest mainstream media does, we realize that our world is in very big trouble due to completely corrupt “leadership.” Our cost of living is too high, our labor market is not healthy and our standard of living is dropping like a rock. Case in point: there are 129 million households in the USA with an average 2.57 people per household. There are 100 million “renter” households in the USA, which tells us that so-called “home ownership” has also fallen like a rock: 78 percent renter households versus 22 percent of households with a mortgage (the usual situation) or outright ownership with no mortgage (the ideal situation).

Asset prices remain severely inflated – global stock markets are a valid case in point. The total number of publicly traded corporations worldwide (companies in which anyone can purchase stock through a stock broker) is now a mere 7,700 or so: https://companiesmarketcap.com/. In other words, investors are chasing ever fewer companies as they invest their monies – mostly their retirement savings in the form of pension plans, 401 K plans or IRAs (individual retirement accounts). They are paying absolutely massive “premiums” over what privately held companies report in their annual reports.

Nevertheless, the stalling global economy is finally affecting the most visible parts of the economy – real estate sales and automotive sales. Year over year compared to July 2022, residential real estate prices in the USA have finally fallen by more than 11 percent, and retail automobile prices have finally fallen by 10 percent: https://prepareforchange.net/2023/07/25/the-most-splendid-housing-bubbles-in-america-home-prices-drop-the-most-year-over-year-in-over-a-decade/?fbclid=IwAR0poJ_Q8cm7nsabpW_jw5EkGCQGwnzVOod_rFPq0Fbsf8Vgw4bSxVnxn5c.

Many so-called “democracies” in the western world are in fact no longer “free” societies – they are “crony capitalist” countries with major political parties following a common (and corrupt) “uniparty” path. The three real branches of government have now been reduced to major investment houses (such as Blackrock and Vanguard), the defense industry (the war industry promoting never-ending wars and now World War 3 versus Russia in the Ukraine) and the pharmaceutical industry (the drug and death industry). The healthiest people on earth are the Mennonite Amish people, who have as little as possible to do with modern society: http://www.domigood.com/2023/07/amish-children-dont-get-cancer-diabetes.html?fbclid=IwAR0zj4PnJTieviP28uc6M-Y6SY_xdmQEb0p5KqfiLtuqL31Th1tbDYSb-Fo.

The war in the Ukraine is of course lost by the west, and the west (most of all the USA and NATO) instigated this war, provoked Russia to enter the Ukraine, by relentlessly expanding NATO toward Russia’s frontier since the collapse of the former Soviet Union in 1991. The goal of the US government and of NATO is to conquer, divide, enslave and rape Russia, so that investment houses such as Blackrock may make even more blood money. But just like Napoleon Bonaparte in 1812 and Adolf Hitler in 1941, the USA and NATO failed to accept that Russia is an utterly massive country…………………too big to fight against. The Russian Army now marching toward the dictator in Kiev outnumbers the Ukrainian Army by 15 to one……………..much like they did the German Wehrmacht from December 1944 to May 1945 (when the Red Army marched from the border of East Prussia to Berlin). Tucker Carlson calls out US foreign policy for what it really is: https://www.facebook.com/messages/t/100018181065025.

Meanwhile, the Biden Administration attempts to jail its political opponents and to silence any and all different opinions. But there are entirely sane voices in the wilderness such as Bobby Kennedy, Jr.: https://www.youtube.com/watch?v=shiizHAOgUM.

Financial, Economic and Social Mood Update (July 1, 2023)

This recent video from Elliott Wave International of Atlanta clearly and graphically illustrates just how weak the American economy and employment market are today – job openings or “help wanted” are now at historically low levels regardless of what is reported in the so-called “mainstream media”: https://www.elliottwave.com/Economy/Have-You-Seen-This-Chart-About-US-Job-Openings?utm_source=com&utm_medium=eml&utm_campaign=ar-cotd&utm_content=cotdrfjobopenings230531.

Yet another disturbing trend in the economy is the fact that brand new real estate costs significantly more to build than it is worth to sell in today’s market. Commercial real estate in the USA already has an astounding 50 percent vacancy rate, and in the residential real estate market this figure is 14 percent. The latter figure is largely due to the fact that many more affluent people have more than one residential property, and that they have no desire to rent those additional properties. In any case, building material & labor costs are such that all real estate cost much more to construct than it is really worth – this holds true for high-end real estate all the way down to so-called “affordable” housing. If you purchase a good insurance policy for your property, you should notice that the entire “blanket” policy is worth much more than the actual property is worth. You will need this coverage in case of emergency, disaster or tragedy because it will cost much more to rebuild the same property from scratch – more than the property is actually worth. For modestly priced homes this “surcharge” will be from 30 to 40 percent more than the property is actually worth. For high-end real estate the same “surcharge” will be much more – say up to 200 percent more than the property is worth. To make a long story short, this tells us that this is NOT a good time to construct brand new real estate.

The international corporate world continues to shrink – in other words, the number of companies continues to go downhill. The Nasdaq Composite Index is down to just 2,500 publicly held corporations. The Wilshire 5000 “total market” Index is down to merely 3,660 publicly held corporations (this was once well over 5,800 companies). The total number of publicly listed corporations worldwide is 7,658 of which only 6,371 have any employees. Total employment of these companies is 110,901,181 and their total market capitalization is USD $91.774 TRILLION – down from USD $124.4 TRILLION on December 31, 2021. In short, this small paragraph has just described for you an accurate snapshot of the entire global equity market today. There is nothing mysterious, magical or amazing about it.

Emerging World War 3

The so-called and much-anticipated Ukrainian “counter offensive” has been launched against Russia, and it is pathetic to say the least. It consists of no more than 55,000 troops of whom no more than 30,000 are actually trained. It may perhaps advance a few kilometers before the massive Russian Army (which happens to be both very well trained and equipped with excellent air cover) releases its fury toward the west. The best time for such an offensive to occur in terms of annual weather will be in June and July of 2023. The situation on the eastern front today is such that events will occur when Russia decides that they will occur – in other words, Russia holds all of the initiative & the west is militarily challenged or even impotent.

The alleged “rebellion” of the Russian Wagner Group is not what has been reported in the mainstream media (the mainstream media now telling no truth about anything whatsoever). The Wagner Group is entirely under the control of the Russian Army, much like the French Foreign Legion is under control of the French Army. US intelligence attempted to “bribe” the leader of the Wagner Group, which filled Moscow in on what was taking place right from the start – hence the quick end to the story and the fully “amnesty” granted from Moscow.

The so-called leadership in the western countries is anything but free and democratic – it behaves in a very authoritarian way. In some western countries, this goes so far that the current regimes in power are using the so-called legal power of the state to silence their political opposition. In any case, they have very little economic, financial and military resources left. Their time is thus limited and they cannot and will not last into the long term future. The whole rotten lot of them have a few years left at the very most. We are witnessing the end of empires, the “Fall of Rome,” the end game or a final death dance.

The deagel.com website lists 189 independent countries ranked by their human population, by the size of their economy and by the strength of their military force. At year end 2021 (18 months ago) Mainland China already had the largest economy in the entire world. The number 2 ranking USA was a full 46 percent smaller than Mainland China.

The most powerful military force in the world as of year-end 2021 belonged to Russia – and this was prior to the massive expansion of the Russian military since early 2022.

The number of sovereign countries abandoning the American Dollar for purposes of international trade, settlement of payments and reserve currency status is now up to a staggering 130 and practically growing by the day. The countries siding with Russia, Mainland China, Iran and their friends versus the USA & its lackey “allies” backing the criminal regime in the Ukraine account for 64 percent of global economic output (GDP), 66 percent of global military strength and 80 percent of worldwide human population. The die has been cast – the final outcome has been determined.

Financial, Economic and Social Mood Update (June 1, 2023)

The Biden-Harris Administration in Washington and their lackey allies around the world are headed for a train wreck of historical magnitude. The G-7 nations (the USA, France, Canada, Germany, the UK, Italy and Japan) produced 70 percent of global GDP in 1976 – that has since fallen to a paltry 27 percent. 117 countries have an inflation rate lower than in the USA. The number of countries which have already abandoned the US Dollar for purposes of global trade & reserve currency status stands at 81 and this number is growing daily. Never mind the theater in Washington, D.C. – the USA has been and is already bankrupt for all intents and purposes. It is not just that inflation is too high – the overall cost of living and asset prices are astronomical and they must come down to the ground. Credit must be deflated and the cost of money must go up – interest rates need to continue to rise. Here is a short article about the possible US debt default from Elliott Wave International of Atlanta: https://www.elliottwave.com/Economy/Hope-for-the-Best-Prepare-for-the-Worst?utm_source=com&utm_medium=eml&utm_campaign=ar-ins&utm_content=insdebtceilinggmp2305.

This nightmare scenario plays out not just in the political capitals of the G-7 countries and not just in collapsing economies – it also plays out in the utterly dangerous, nonsensical, needless, useless, destructive and immoral Ukraine War which threatens to grow into a 3rd World War due to the reckless policies of the USA and her lackey allies. As the former Third Reich did under Adolf Hitler, the current administration in Washington, D.C. is moving toward an utterly mad & insane 4 front global war. The Eastern front is against Russia and her allies in Eastern Europe, Central Asia, the Middle East and Africa. The Western front is against Mainland China (over the falsely engineered issue of Taiwan) and her allies in East Asia, Southeast Asia and South Asia.

A Southern front is emerging due to 1) uncontrolled illegal immigration and 2) reckless threats from Washington over the drug war against Mexico and the nations of Latin America and the Caribbean. The worst-case scenario for the USA will be similar to what transpired in Eastern Europe after World War 2 when more than 1,320 years of German & Christian settlement was wiped out in the largest forced transfer of land and human beings in human history. Just look at a map of what was once controlled or claimed by the Spanish Empire in the Western Hemisphere – more than half of the modern day USA and even much of western Canada is at risk:

Finally, a Northern front is emerging in the form of political devolution which will create Native American Indian nations – this can already been seen in formerly Danish Greenland and in the former Northwest Territory of Canada where the new territory of Nunavut has been created:

The USA and its lackey allies are pursuing an insane policy of “identity politics” which seeks to divide human beings based upon supposed identity groups – not unlike the former racial policy of National Socialist Germany from 1933 to 1945. The disastrous result will be the Balkanization of human beings – a “divide and conquer” strategy promoted by the likes of George Soros and the World Economic Forum (WEF) led by Klaus Schwab in Switzerland.

Emerging World War 3

What is left of the Ukrainian military will launch one (1) final counter-offensive before they are permanently finished off by the Russian army – much like Hitler launched what became known as the Battle of the Bulge in December 1944…………………….it was Germany’s final offensive operation toward the end of World War 2. The criminal Biden Administration now seeks to promote a “frozen” border in the rump Ukraine, much like what happened on the Korean peninsula in 1953 (a permanently divided North and South Korea with US troops in South Korea). This time, the idea is for American, British, Polish, Romanian and Lithuania troops to enter western Ukraine. Russia will never tolerate this, which will lead to the war spilling over into Europe proper within the coming 5 months. I would not recommend anyone from outside of Europe to travel to Europe for any reason whatsoever in the coming year or so. Much like American tourists who took an ocean voyage aboard the British passenger liner SS Lusitania in 1917, this could easily lead to foreign travelers losing their lives…………..it isn’t worth it, and there are many other places people can travel to closer to home and much safer.

The cumulative human casualties in the Ukraine war are already massive. 84 percent of the Ukraine’s prewar population is already dead, wounded, fled the country as refugees or left destitute with no homes or livelihood………………67 million out of 80 million people. A mere 13 million people are left under the rule of the rump government in Kiev. The ratio of casualties between the so-called Allied and Russian sides is also utterly lopsided………………..41 total Allied casualties for every one Russian casualty and an incredible 126 Allied dead for every one dead Russian. This madness never should have begun, the governments in the west never should have provoked this war especially since 2014 & this insanity must be stopped immediately. We desperately need new national political leaders in the west, most especially in the USA in the November 2024 Presidential and Congressional election.

Financial, Economic and Social Mood Update (May 1, 2023)

There are important signs that the both economic-financial and the geopolitical fronts of the western world are starting to buckle (i.e. collapse) in a significant way. Both the seaports on the east coast of the USA (the largest being Norfolk, Virginia) and on the west coast of the USA (the largest being Long Beach, California) are unusually and abnormally quiet. The main reason for this is that consumer demand is weakening by the day – the resources of the consumer have been spent and there is not much left in reserve. Consumer spending comprises 70 percent of GDP or Gross Domestic Product.

Major retailers like Walmart are closing stores in big cities or even pulling out altogether – specific examples include Chicago, Illinois and Portland, Oregon, respectively. Target is planning major staff (or paid hour) reductions in employment. Kroger (the 2nd largest supermarket grocery store chain in the USA) just announced miserable results for the most recent quarter as did D.R. Horton (the largest homebuilder in the USA). Cumulative job cuts at large corporations have reached almost one-half million employees, the biggest number of these coming from Amazon.com. Inflation and an already very high cost of living remain serious problems – the latest annually adjusted figure out of the United Kingdom is 10 percent………………….and we all know that the real numbers are far worse than the “official” numbers regardless of country. 44 percent of US workers are working two or more jobs – not by choice but by necessity.

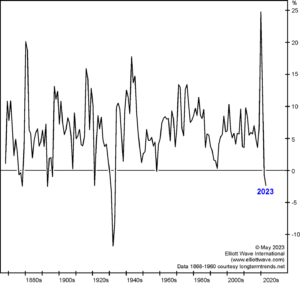

39 percent of American households have actually skipped a meal to afford their house payments – in households headed by young adults this figure is an astounding 44 percent. 14 percent of American homes are now vacant (along with 50 percent of American commercial real estate – proving that we have a severe oversupply of existing developed real property). The world record for vacant housing is in Japan at a whopping 33 percent due to a very old demographic – a rapidly ageing population with too many older people and not enough younger people (not enough births). And by the way, interest rates (the cost of borrowing money) is not too high – they remain too low proven by the fact that our cost of living remains far too high…………………prices remain too high / too inflated. Here is a good Elliott Wave International video on the history of interest rates going back a short period of just 70 years to the 1950s: https://www.elliottwave.com/Interest-Rates/A-Seven-Decade-Chart-of-Interest-Rate-Spikes-and-Crises-Here-We-Go-Again?utm_source=com&utm_medium=eml&utm_campaign=ar-cotd&utm_content=cotdrfintratespikes240412. The money supply has already fallen more than at any time since the Great Depression, which is still more evidence that we are on the cusp of a deflationary collapse to take place immediately following our experience with high inflation (see the graph below which goes back to the year 1870):

On the geopolitical front, the US Dollar continues to lose its status as the dominant reserve currency which it has held since 1944. Countries throughout Asia, Africa, and Latin America are moving away from the US Dollar, from the USA, and toward the BRICS alliance (Brazil-Russia-India-China-South Africa), the Shanghai Cooperation Organization and Mainland China’s Belt-Road Initiative. The first major “crack” in the western front line is France, which has stated its will to move away from the USA and toward China – this is also having a direct influence on western military support for the highly dangerous and futile Ukraine war directed against Russia. Once Germany cracks, Europe will become impotent. Germany has been, remains and will continue to be Europe’s locomotive, corner-stone and center of power. Without Germany, there is no Europe.

Contrary to what the corrupt governments in the west parrot, there is no need for “regime change” in eastern countries such as Russia or China. The need for “regime change” is in the USA, Canada, Japan, South Korea, Australia, New Zealand and in virtually all of Europe. The powers that be in the western world are clearly pushing for a Third World War against the massive Eurasian landmass – against Russia in the Ukraine and against Mainland China in Taiwan. At the very worst this will lead to global thermonuclear war; at the very best it will lead to the total defeat of the west. The so-called Ukrainian imminent “counteroffensive” will pit 200,000 Ukrainian conscripts (older men, boys and some women) against One Million highly trained and very well equipped Russian Army troops with near total Russian air superiority. The Ukrainian Air Force has lost an astounding 400 plus combat jets (with trained pilots now dead) and more than 20,000 drones in the last month alone. There are two (2) annual periods of extreme rain which make the deep & fertile soil / farmland of Eastern Europe unpassable (where most roads remain unpaved to this day) which deter mechanized and even horse-driven armies from moving. One is right now (the months of April and May) and the one before this was in November. Recall when the most massive military offensives were launched on the Eastern Front during World War Two: German Operation Barbarossa toward Moscow & Leningrad on June 22, 1941, German Case Blue toward the Volga River & Stalingrad on June 28, 1942, German Operation Citadel toward Kursk on July 5, 1943 and the Soviet Russian Operation Bagration to destroy German Army Group Center on June 22, 1944. There was a reason why these massive offensives were launched during the months of June & July……………large armies require solid unpaved roads and warm-enough weather. Needless to say that the combined losses on all sides were utterly massive beyond comprehension – 47.7 million human beings, 7.5 million army horses, 15.9 million cattle and 21.5 million sheep which were “conscripted” for military purposes. Trained dogs were often used for “suicide” missions – for detonating explosives under enemy tanks, for instance. The number of military vehicles expended (lost) such as tanks, armored fighting vehicles, self-propelled artillery pieces, trucks, cars and motorcycles were 8.1 million. Needless to say that most of the soldiers, animals, trucks, cars and motorcycles on all sides were conscripted or “confiscated” from peaceful prewar life to serve and die during wartime. Total worldwide losses & casualties during World War Two were at least 131 million human beings, 123 million animals and 22 million vehicles.

The numbers today will eventually be far worse. Note that the Ukraine had a peak human population of 52 million 30 years ago in 1993. Today, the rump dictatorial government in Kiev rules over perhaps 13 million people – a reduction of 39 million people to date.

In sum, there is only one sane and humane solution: negotiate peace and stop all war immediately and forever.

Financial, Economic and Social Mood Update (April 2, 2023)

Inflation (or more accurately: the loss of purchasing power) in North America, Europe, Australia and other countries tied to the west is in no way “transitory” – on the contrary, it looks to be permanent and getting worse by the day. In your own lives, look at the prices in the grocery store, for your monthly utility bills and for insurance – especially something like homeowner’s insurance. All of these prices have literally skyrocketed over the past few years.

The political & the financial system power structure in the western countries appears to be collapsing by the day as well, driven largely by an insane desire to promote conflict with and in much of the rest of the world. The power structure “on the other side” is becoming ever more independent from the west, specifically from the post-World War 2 hegemony of the American Dollar. The illegitimate Biden regime in Washington, D.C. is now presiding over the collapse of the American Empire which has ruled the world since 1945.

This “other side” power structure can be seen emerging most clearly in institutions such as the “BRICS” countries (these are Brazil, Russia, India, China and South Africa), in the SCO (the “Shanghai Cooperation Organization” which includes almost all of Asia) and in the Chinese BRI (“Belt and Road Initiative”). Note – BRICS actually includes the 5 main founding nations plus 3 applicant nations (Algeria, Argentina and Iran), 5 more nations which have officially expressed interest in applying for membership (Afghanistan, Egypt, Indonesia, Saudi Arabia and Turkey) and finally 6 additional nations now in official dialogue for BRICS expansion (Kazakhstan, Nicaragua, Nigeria, Senegal, Thailand and the United Arab Emirates).

The Belt and Road Initiative includes most of Asia, South America, Oceania, Australia, Europe, Canada and about half of Africa. The goal of the BRI is to tie the world to mainland China via infrastructure projects, economy and finance. The countries partaking in these initiatives are gradually moving away from the US Dollar as a medium of exchange and they are also unloading ever more of their holdings in the massive USD $31 TRILLION US national debt.

In a nutshell, this means that the American Dollar will continue to lose ever more of its purchasing power, which translates into an ever declining standard of living in the USA. The decline of the US Dollar is one reason I believe that interest rates & bond yields will not decline soon. One asset that is not “trash” is cash – be this in the USA or the rest of the world. Real estate, bonds (i.e. debt), tangible goods (things you can “touch” such as automobiles, etc.), precious metals (the best known one being gold bullion), corporate stocks and digital electronic cryptocurrencies all remain depressed and will likely remain depressed for many years to come.

The middle class is already almost gone – think about the fact that 80 percent of the American population already depends upon highly subsidized government healthcare through the likes of Medicare, Medicaid, Medi-Cal and Obamacare, and that about half of the US population no longer files an annual income tax return.

The modern day United States of America is experiencing something similar to the “Fall of Rome” which has happened to all formerly great global powers in the past. Think about what happened to the United Kingdom (England) especially after the fall of the former British Empire after World War 2 when American global hegemony replaced British hegemony. The purchasing power of the once mighty British Pound has collapsed over the course of hundreds of years, and the same thing is happening to the American Dollar today. The British Pound Sterling emerged between A.D. 600 and 800 (more than 1,400 years ago) and the Bank of England was the world’s first modern “central bank” which practiced “money printing” (in the form of modern credit inflation). The Pound has lost more than 96 percent of its purchasing power since 1945 alone according to the British House of Commons Library. The Pound has lost 99.3 percent of its purchasing power since 1751 when the British House of Commons Library began keeping annual inflation statistics.

The corrupt mainstream media (owned & controlled by the likes of the WEF World Economic Forum through major investment firms such as Blackrock & Vanguard) does not report this, but there are now massive popular demonstrations in many countries where governments are not legitimate. These countries include France, Israel, the United Kingdom, Portugal, Greece, Moldova, Nigeria, Venezuela and South Korea. Massive strikes have brought Germany to a halt. The European economies are now much worse off compared to the USA due to the American-led boycott of & war against Russia. Most of the European countries are now desperately trying to restart economic trade with China, because they are in dire need of the raw materials & natural resources from Asia, Russia & beyond. The Battle of Bakhmut in the Ukraine has turned into NATO’s Stalingrad. After Russia mops this up & after the spring rains cease (most roads are not paved in this part of the world are thus muddy beyond description), Russia will march west to neutralize what remains of the Ukraine. Napoleon Bonaparte was stupid enough to try to invade Russia in 1812. Adolf Hitler repeated the same mistake in 1941. NATO repeated this mistake yet again through its proxy the Ukraine in 2014/2022……………………..the end result will be no different.

Our entire global economy & society reached a “peak” in optimism & nominal prices at the end of 2021. This speech by Robert Prechter of Elliott Wave International illustrates this clearly: https://my.elliottwave.com/products/club/event.aspx?guid=d3a36c43-8759-4d48-b7ba-37a69f8c2e66. All of human society – be it the economy or mass human social mood, is now in the throes of a massive collapse. Here is yet another pertinent article by Elliott Wave International backing this up: https://www.elliottwave.com/en/Articles/2023/03/14/17/29/3-Stock-Indexes-One-Message.

Financial, Economic and Social Mood Update (March 1, 2023)

The US Department of Labor claims that a record 160 million Americans are employed, but this figure “double counts” people with more than one job. Furthermore, most large corporations are either laying people off or they have frozen hiring. Both the very important real estate sector and the automotive sector have severe levels of over-capacity. For instance, roughly one half of US commercial real property is currently not being used. The largest US homebuilding corporations are seeing more than two-thirds of their existing new home contracts cancelled by buyers. Potential buyers are pulling back due to job layoffs and due to their diminished purchasing power. The following excellent video by Elliott Wave International of Atlanta, Georgia clearly demonstrates how one asset market went from a market value of USD $18 TRILLION to ZERO in just 2 years (the global market for negative yield bonds). Note that this historically odd market was created by world governments flooding markets with “printed money” or easy credit, which is not a normal or healthy situation and which could not last forever: https://www.elliottwave.com/Market-Trek#15?utm_source=com&utm_medium=eml&utm_campaign=ar-ins&utm_content=insightsmarkettrekepi16.

Emerging World War 3

I wish that this were not happening, but it is. The countries in the west are being led by people who have no experience with or memory of war – hence they no longer fear what every rational person should and must fear. The foreign policy of the west is doing the bidding of the all-powerful and all-evil World Economic Forum (WEF) led by Klaus Schwab in Switzerland. This policy threatens to basically “colonize” much of the rest of the world and absurdly attempt to remake it in the image of the modern-day USA, the mainstream media and Hollywood – hence the threats to promote “regime change” in countries such as Russia, the countries of the former Soviet Union, Serbia, the Balkans, Mainland China, North Korea, Iran, much of Africa and much of the Islamic world. The fatal mistake here was to enlarge the European Union (EU) and the North Atlantic Treaty Organization (NATO) into the countries of the former Soviet Union, specifically to the borders of Russia in the form of the Ukraine, which is itself the historical origin of both the modern Russian nation state and of the Russian Orthodox Church.

The military forces being amassed by Russia & her allies on the Eastern Front today have the very real ability to grow into the largest military force in recorded human history. 700,000 troops equipped with 8,000 tanks & other armored fighting vehicles (AFV) such as infantry fighting vehicles (IFV) & mobile missile platforms are already deployed in three (3) army groups surrounding what is left of the Ukraine – from the north in Belarus, from the east in the Donbas region and then in the south just above the Crimea. Behind these troops in Russia, Belarus & Serbia are many more troops which can raise the troop level to 6.5 million men equipped with 85,000 tanks & other military vehicles. If need be, all of the Eurasian & African countries behind Russia have a combined resource of 786 million able-bodied potential soldiers – a force which will outnumber whatever the western countries can muster by more than 3.3 to one.

I recently heard an American college professor claim that the combined nuclear arsenals on earth could NOT destroy all life on earth. He is totally wrong in his belief and claim. Based upon what the US Army Air Force did to the Japanese cities of Hiroshima & Nagasaki in August 1945, the combined nuclear arsenals of today could kill everyone & everything on planet earth 5.7 times over. Furthermore, a whopping 83 percent of this combined nuclear firepower (with its utterly lethal radiation) belongs to Russia and her allies.

The only sane option here is to negotiate an end to the Ukraine war and to respect Russia’s right to her own sovereignty & to respect her geopolitical sphere of influence. The entire policy of “regime change” must end for all time. NATO should be disbanded=ended=terminated for all time as was the former Warsaw Pact in 1991. The European Union (EU) must cease its expansion for all time and reduce its governmental scope back to what it was in the 1950s to 1980s.

There has already been far too much duplicity & outright criminality. The Biden Administration along with the government of Norway deliberately destroyed the Nord Stream Pipeline which was exporting fairly priced Russian natural gas into Western Europe. This criminal act was meant to keep Europe subservient to the military-industrial complex of Washington, D.C. – this was an act of colonialism meant to keep one group of human beings subservient to another group of human beings.